Western Siberia, home to the Bazhenov and Achimov Formations, boasts a wealth of opportunities for hydraulic fracturing. Photo: Vadim tLS Andrianov // Wikimedia Commons.

“The whole is greater than the sum of its parts.”

Facing an uphill battle against sanctions, dwindling oil prices and oilfields in decline, a team of Russian scientists have joined forces to give fresh meaning to the saying coined more than two millennia ago by Greek philosopher Aristotle.

Led by Skoltech and the Moscow Institute of Physics and Technology (MIPT), a consortium of leading oil and gas researchers and IT specialists are creating an innovative software program that could boost Russian oil production and breathe new life into the country’s energy sector.

In 2014, the United States, members of the European Union, and several other countries imposed a sweeping series of sanctions against Russia in connection with its conflict with Ukraine.

Three years later, the sanctions – which primarily targeted Russia’s financial, arms and energy sectors – remain intact, and appear in some cases to have had the unanticipated consequence of bolstering a sense of domestic self-reliance.

Case in point: hydraulic fracturing.

//Sanctions and the rise of hydraulic fracturing

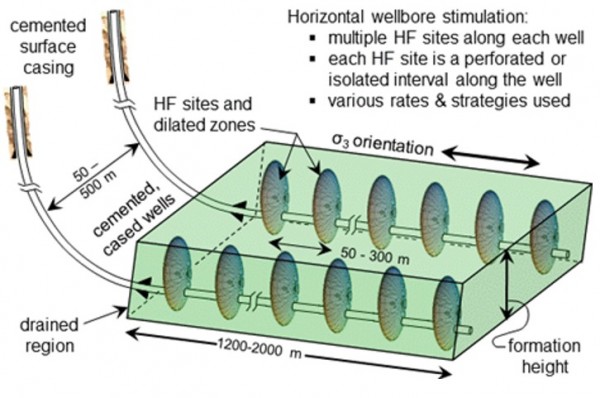

Though hydraulic fracturing has been used commercially since 1947, it only emerged in the popular international discourse in the early 2000s, when technological advances such as multi-stage fracturing and horizontal directional drilling (see image below) made the method cost-effective in ultra-low permeability gas shales for the first time in its history by improving reservoir contact.

A scheme of the multi-stage fracturing operation in near-horizontal well for the stimulation of shale gas production. Photo: obtained from this academic paper.

The method is broadly referred to in the media as “fracking,” but the term “hydraulic fracturing” is favored by industry experts, who consider the latter to be more technologically accurate.

Put simply, hydraulic fracturing is the process of blasting water mixed with particles of sand or other abrasive materials into wells with the intent of creating or exacerbating fractures within shale – a type of sedimentary rock with extremely low permeability – and other unconventional resources. The particles are then lodged into the fractures to prevent them from closing up and to create highly conductive channels to transport hydrocarbons from a far-field reservoir towards the well and then to the surface.

Ultimately, the fractures boost oil production by increasing the surface area of contact between the hydraulic fracturing channel and the hydrocarbon-containing reservoir.

The potential of hydraulic fracturing to increase oil and gas production while decreasing consumer costs is undisputed. In a 2015 report, The Brookings Institution credited a hydraulic fracturing boom in the United States with having decreased consumer gas bills by $13 billion annually between 2007 and 2013.

“Innovations in drilling and hydraulic fracturing have enabled tremendous amounts of natural gas to be extracted from underground shale formations that were long thought to be uneconomical,” the report read.

This may account for the fact that shale was explicitly targeted by both the United States and the European Union when they imposed their respective sanctions.

Under the US sanctions, companies are prohibited from providing their Russian counterparts with goods, services and technologies related to the production of oil from shale. The EU sanctions similarly prohibit companies in member states from exporting innovative extractive technologies to Russian companies for use in developing shale oil reserves.

“The sanctions were specifically imposed to prevent technology development in this area, in addition to Arctic and offshore drilling projects,” said Professor Andrei Osiptsov of Skoltech’s Center for Hydrocarbon Recovery (SCHR).

Prior to the sanctions, Russian oil companies were already keeping an eye on the spread of hydraulic fracturing. According to Financial Times, several joint ventures between Russian and Western oil giants were suspended in the immediate aftermath of the sanctions.

This left Russian oil companies, who at the time were dependent on their Western counterparts for the software and other technologies related to hydraulic fracturing, at a loss.

But rather than opting to put their hydraulic fracturing ambitions on the shelf and wait for the sanctions to be lifted, industry leaders like Gazprom Neft, Rosneft, Surgutneftegas, Novatek and Lukoil have pooled their resources to inspire the creation of homegrown solutions.

“They are all equally interested in having the best technology,” said Osiptsov. “This is a point where they need to join forces.”

//Why Russia needs hydraulic fracturing

Russia is known to be a world leader in oil production, and oil and gas comprise the very core of the national economy.

But with readily available oil reserves drying up, the country is coming to grips with the realities of its dramatically different, albeit still abundant, oil reserves.

“If we consider the oil production forecast for the future, and if we take into account Russia’s existing oilfields, we see that oil production in the country will diminish very quickly,” said Professor Mikhail Spasennykh, Director of the SCHR. “To maintain the same production level, the Russian oil industry has a couple of options: either produce more oil from existing oilfields, or produce oil from unconventional resources like shale.”

With respect to existing oilfields, Russian companies face growing obstacles in the form of oil deposits stored at ever-greater depths, paired with decreasing permeability.

The Bazhenov Formation – widely believed to be home to the world’s largest shale oil deposit – and the Achimov Formation, both in Western Siberia, are prime illustrations of this conundrum.

“Usually when we talk about oil in Western Siberia, we’re talking about more or less conventional oilfields with a depth of one to one-and-a-half kilometers – reservoirs characterized by good permeability and porosity. And the Russian oil industry is completely prepared to produce oil under these circumstances without any problem,” Spasennykh said.

“But as we drill deeper, permeability decreases. The most complicated case is the Bazhenov Formation, which has a depth of three kilometers. The Achimov Formation is slightly shallower, but it also has very low permeability. At present, the industry is struggling with how to produce oil from both of them,” he said.

To surmount these obstacles, government and industry leaders are investing in technological innovations such as hydraulic fracturing, which was first introduced as a means of stimulating production from mature wells experiencing production declines.

“The existing oil production technologies are not effective for the production of oil from low-permeable reservoirs, so more and more we need to apply the technology of hydraulic fracturing. You cannot produce oil just by drilling wells anymore, because production from one well without hydraulic fracturing is not enough,” Spasennykh explained.

//Russian hydraulic fracturing before and after sanctions

Prior to the sanctions, leading Russian oil companies routinely purchased hydraulic fracturing services from independent oilfield service companies, which typically began by executing a hydraulic fracturing stimulation treatment. To design the stimulation treatment ahead of field operations, these companies relied on simulation software.

Before the sanctions were imposed, oilfield service companies operating in Russia mostly relied on simulation software from the West.

A typical footprint at a well site during a multistage fracturing job in North America, from a recent review paper on fracturing. Pump tracks are seen in the center, connected to the main line going into the well, and trailers with the fracturing fluid on the perimeter. Photo: Custom Aerial Images

Suddenly, in 2014, this option was off the table. “Under sanctions, we cannot use existing technologies developed in the United States or Europe, and we can’t apply special software which allows us to model this process for the optimization of hydraulic fracturing,” Spasennykh said. “For this reason, several companies decided to initiate the discussion about how to develop a Russian hydraulic fracturing simulator.”

In fact, Osiptsov explained, there had been an elevating desire to “develop this technology in Russia, by Russians, for Russian oilfields,” for years prior to the sanctions.

Timur Tavberidze, Managing Director of MIPT’s Center of Engineering, reiterated this point, explaining that hydraulic fracturing has become a trend in Russia: “According to experts’ estimates, the volume of hydraulic fracturing operations in Russia is expected to reach $2 billion by 2023.”

That said, increased operations have led to increased difficulty. “The complexity of technological operations associated with fracturing in horizontal wells in difficult geological conditions has also increased,” Tavberidze said. “This leads to an increase in the need for high-precision engineering calculations in the design and maintenance of hydraulic fracturing.”

Hence the need for top-notch, Russia-specific simulation software, according to Tavberidze’s colleague Dr. Artem Erofeev, a project manager with the MIPT Center of Engineering who is working with the consortium.

“Foreign software products for hydraulic fracturing modeling occupies a dominant market share,” Erofeev said. “But only software based on simplified models, developed more than 10-15 years ago, is available on the Russian market. Advanced solutions, especially for shales, are not presently available due to the sanctions. Therefore, the development of a domestic IT product for hydraulic fracturing modeling is one of the priority tasks for import substitution in the area of software for the oil and gas industry.”

In a similar vein, Professor Anton Krivtsov, a corresponding member of the RAS and head of the SPPU Oil and Gas Center, pointed out: “The development of a Russian hydraulic fracturing simulator will decrease the influence of sanctions on Russian oil and gas companies.”

After leading Russian oil companies teamed up to initiate the process of creating a new simulator, each weighing in on the features of the ideal hydraulic fracturing simulation software, they passed their requirements along to the Russian Government – via the Ministry of Industry and Trade, the Ministry of Energy and the Ministry of Communications – which joined forces with the Skolkovo Foundation to launch CyberFrac, a competition for the creation of the software.

//Assembling an unbeatable alliance

Though Skoltech was quick to rise to the challenge, Spasennykh – who spent years working in the oil industry’s R&D sector before returning to his academic roots – knew from the start that neither it nor any other Russian institute or company had all of the intellectual and technological resources required to create the optimal simulator.

“We realized that this was an incredibly complex task and there is no university or company that could do it alone,” he said.

Osiptsov joined Spasennykh’s team at Skoltech in October 2016, and immediately set to work building a consortium, aiming to fill its ranks with the best and the brightest academic departments and IT companies Russia had to offer, and striving to select partners with unique and complementary skillsets.

He was uniquely equipped for the job thanks to his extensive industry background, which included a stint developing prototypes of simulators for hydraulic fracturing, transient multiphase flow in wells, and other projects for the leading international oilfield service company. (See his recent review paper for more details on hydraulic fracture simulation).

“I immediately began preliminary negotiations with other scientific groups in universities and institutes of the Russian Academy of Sciences to evaluate their capabilities, skills, and experience,” Osiptsov said.

“And then, we started visiting oil companies in Russia and this is where Professor Spasennykh’s wealth of contacts within the industry was specifically useful, because basically we were very well received everywhere,” he added, noting: “Overall, our goal was to evaluate the technological demands and gauge the expectations of major Russian oil and gas producers.”

Based on their findings, the Skoltech team developed a research proposal, and then shared their vision with a few key academic departments that they hoped to work with.

Ultimately, Skoltech teamed up with the Moscow Institute of Physics and Technology (MIPT), the Gubkin Russian State University of Oil and Gas, the Peter the Great St. Petersburg Polytechnic University (SPPU) and several of the institutes within the Russian Academy of Sciences (RAS), including the Lavrentyev Institute of Hydrodynamics (RAS-LIH), the Institute of Applied Mathematics and the Institute of Oil and Gas Geology and Geophysics.

“Each of these had active projects with oil companies in Russia on elements of hydraulic fracturing simulation. None of them has a commercial version of the software currently, but they had either research prototypes or particular elements, which could become components of the future project,” Osiptsov said.

“I think the other academic groups were drawn to Skoltech due to our unique access to companies and our understanding of what needs to be done on the research side, which stems from our past experience of involvement with key industry experts in hydraulic fracturing simulation. We do our best to keep these links with the academic community worldwide to stay up-to-date with the cutting edge in modeling,” he added.

The consortium also lured in several leading IT companies working in Russia’s oil and gas sector, including Geosteering Technologies and Jet Technologies, among others.

In addition to Skoltech Professors Osiptsov and Spasennykh, we talked to the following consortium members for this story: from left, Timur Tavberidze and Dr. Artem Erofeev of the MIPT Engineering Center; Prof. Dr. Sci. Anton Krivtsov and Professor Vitaly Kuzkin of SPPU; and Professor Dr. Sci. Sergey Golovin of RAS-LIH. Photos provided by consortium members.

//Building simulation software from the ground up

Once the team was assembled, it set to work developing hydraulic fracturing simulation software, largely from scratch.

“In developing this software, we’re not able to reuse anything from other companies because those are their trade secrets – their own resources,” Osiptsov said.

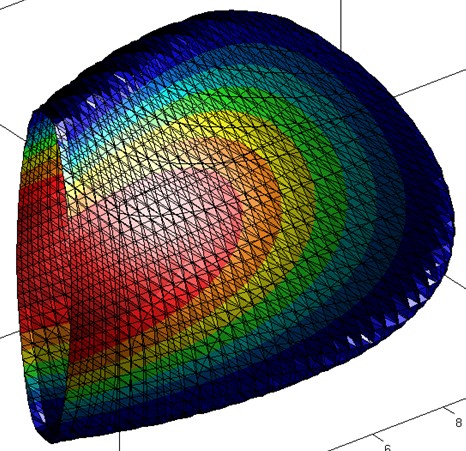

The Full 3D model of fracture growth coupled to the fluid flow inside, developed earlier by the consortium members.

He noted, however, that following decades of research, there is a great deal of public knowledge with respect to hydraulic fracturing. “There is a lot of science published in open literature; there are detailed literature reviews and lots of papers, and each of the scientific groups included in our consortium have their own experience and expertise in specific parts of the process, and they have their own research codes and parts of prototypes,” he explained.

As far as Spasennykh and Osiptsov are concerned, being untethered from the working models currently favored by US and EU oilfield service companies will better equip the consortium to tackle issues that are unique to Russian shale.

“Shales and shale formations are different in North America and in Russia,” Osiptsov said. “In the United States, the typical shale formation, like the Bakken Formation, is like a sandwich, so the low-permeability reservoir layer containing shale oil is very well isolated from the source rock, which is almost impermeable. Hence, it is relatively easy to target the oil-bearing layers with directional drilling and multi-stage fracturing. In Russia, in the unconventional formations like the Bazhenov, it’s more like lasagna: source rock layers and reservoir layers are mixed on a much smaller scale, and hydrocarbons are present in the form of kerogen contained in the ultra-low-permeability source rocks.”

Toward this end, the team is developing fracture growth models that are better tied to the specifics of Russian shale fields.

Spasennykh added: “We’re planning to create a better simulator than what exists now.”

SPPU Professor Vitaly Kuzkin likewise said that the consortium is striving to create a simulator that is superior to its counterparts on the market in terms of transparency. “Another issue with existing simulators is that they work like black boxes. It is unclear what models are implemented and what is the range of applicability of these models. We are planning to develop the simulator in collaboration with leading Russian oil and gas companies so that our simulator will be transparent for the users,” Kuzkin said.

And if they do succeed in creating a simulator that outshines its Western predecessors, the team plans to put it on the global market.

Armed with some of Russia’s greatest hydraulic fracturing minds and fueled by the desire to create a product that would surpass the technology currently barred by sanctions from Russian oil companies, the consortium developed a software prototype and won the CyberFrac competition.

Members of the consortium at the Skolkovo Technopark after their victory at the CyberFrac contest. Photo: Skoltech.

“In summary, our success in the competition was due to several factors,” Osiptsov said. “First, we naturally had access to feedback from key oil companies to see what they really need. Second, we know very well the key scientific groups in Russia and have strong working relations with them.”

Their triumph made the consortium eligible to apply for a government grant that will cover nearly half of the total project budget of ~RUB 500 million (~EUR 7.5 million). The remaining funds will be covered by the entities comprising the consortium, as well as private investors.

Product development is expected to start later this year and to endure for approximately three and a half years. The consortium expects to release updated versions of the software during each year of the development phase.

The team will rely on Skoltech’s Renova Lab to conduct research on the mechanical properties – such as porosity and permeability – of rocks involved in the hydraulic fracturing process. “This is an important task because you can’t provide good optimization if you don’t know about the type of rock you’re dealing with, so our lab provides input data for the new simulator,” Spasennykh said. The Renova Lab itself is a reflection of the potential of universities to come together to create something truly spectacular: it’s equipment was designed by engineering professors from the University of Calgary, and then constructed in Canada for Skoltech’s use.

As the consortium gears up to create Russia’s first hydraulic fracturing simulator, Spasennykh reflected on what this means for the country: “This isn’t just about business; it’s a question of security for Russia in the area of oil production. Sure, the new simulator will be sold and it will generate some cash flow from industry, but more importantly, Russia should have such a simulator, and the whole industry should have the opportunity to apply this simulator in future hydraulic fracturing operations.”

Professor Sergey Golovin, Managing Director of consortium member RAS-LIH, praised the team’s work as a stellar example of the whole being greater than the sum of its parts.

“This is the first time that the creation of such a highly scientifically-loaded product was initiated by gathering competences from so many different organizations, institutes and universities,” Golovin said. “This approach allows us to meet each other, to evaluate the level of Russian science in this field and to understand our strengths and weaknesses. I expect this project to give a strong impulse to all of us to work on the development of science in this area, to communicate with each other and to produce a commercial product that’s poised to compete on the global market.”

The consortium wishes to express its gratitude to Gazprom Neft and other leading Russian oil and gas companies, including Rosneft and Lukoil, for joining forces on this initiative and for providing incredible support with respect to the creation of Russia’s own hydraulic fracturing simulation software.

Members of the consortium and the jury, posing after the final. From left to right: Sergey Arkhipov (Head of the Expert Council for CyberFrac competition, Gazpromneft), Professor Andrei Osiptsov (Skoltech), Timur Tavberidze (MD, Eng. Center MIPT), and the members of the jury from the government.